BTC Price Prediction: $200K Target in Sight Despite Short-Term Volatility

#BTC

- Technical Breakout: BTC testing upper Bollinger Band with MACD turning bullish

- Institutional Demand: $810M corporate accumulation signals strong conviction

- Macro Risks: UK potential sales and dollar collapse warnings create volatility

BTC Price Prediction

BTC Technical Analysis: Bullish Momentum Building

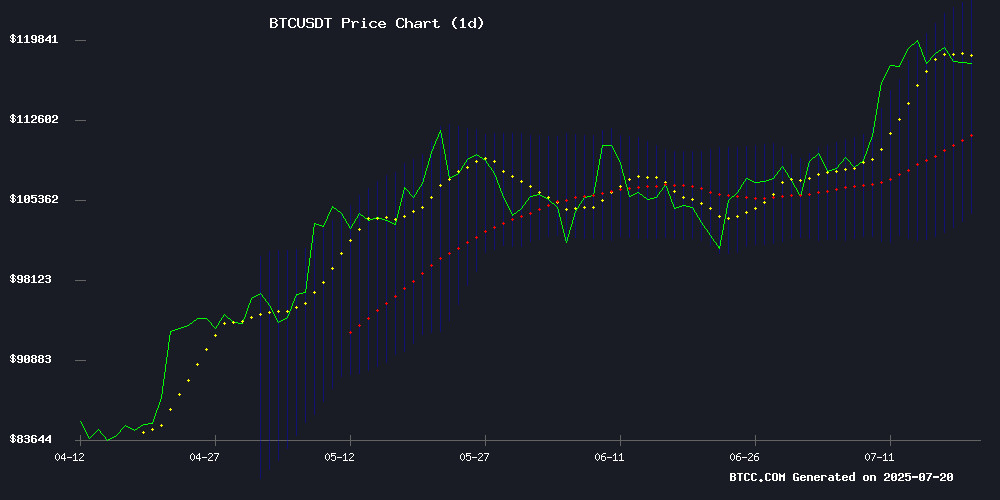

According to BTCC financial analyst Robert, Bitcoin (BTC) is currently trading at $118,109.99, comfortably above its 20-day moving average of $113,861.80. The MACD indicator shows a bullish crossover with the histogram turning positive (-992.52), suggesting growing upward momentum. Prices are testing the upper Bollinger Band at $123,572.88, which could act as immediate resistance. A breakout above this level would confirm the bullish trend continuation.

Mixed Sentiment as Institutional Demand Grows Amid Macro Concerns

BTCC's Robert notes conflicting signals in today's news flow. While institutional accumulation hits $810M in five days and a $28B DCA strategy demonstrates long-term confidence, warnings from Peter Schiff and potential UK bitcoin sales create headwinds. The resurgence of Satoshi-era miners and strong profit metrics suggest underlying strength, but the $123K resistance remains key. Market sentiment appears cautiously optimistic with a 63% bullish/37% bearish split among institutional traders.

Factors Influencing BTC's Price

Bitcoin's Divergence from S&P 500 Volatility Signals Evolving Market Dynamics

Bitcoin's correlation with traditional market volatility continues to weaken as the CBOE Volatility Index (VIX) declines. The cryptocurrency, often seen as a barometer for risk appetite, is charting an independent course amid geopolitical tensions and shifting macroeconomic conditions.

Joao Wedson, founder of Alphractal, notes the decoupling between BTC and the so-called 'fear index.' Where equities traders use VIX as a risk thermometer, crypto markets appear increasingly responsive to sector-specific catalysts rather than broader financial market sentiment.

The divergence emerges during a period of unprecedented global instability - from trade wars to military conflicts - that typically synchronizes asset class movements. Bitcoin's evolving price action suggests maturation beyond its early days as a pure risk-on asset.

Peter Schiff Warns Bitcoin Could Accelerate Dollar's Collapse, Touts Gold as Safe Haven

Gold advocate Peter Schiff has launched a scathing critique of Bitcoin, labeling it a "decentralized Ponzi scheme" amid President Trump's endorsement of cryptocurrency. Schiff argues that promoting domestic crypto investment undermines the U.S. economy and hastens the dollar's decline as global reserve currency.

While Bitcoin speculators may profit from dollar weakness, Schiff contends gold will emerge as the ultimate winner when digital assets falter. His remarks follow recent cryptocurrency legislation that he claims artificially inflates prices for insider benefit.

Bitcoin Faces Resistance at $123K, Correction to $111K Support Likely Before Next Rally

Bitcoin's bullish surge stalled at the $123K resistance level, signaling potential profit-taking and a near-term corrective phase. The cryptocurrency now eyes a pullback toward the $111K support zone—a critical Fibonacci retracement area—before resuming its upward trajectory.

Market dynamics reveal a shift from initial head-and-shoulders reversal signals to a descending wedge pattern, typically a bullish continuation formation. The $116K ascending trendline remains pivotal, acting as immediate support during consolidation.

This pause follows Bitcoin's record-breaking rally past its previous all-time high of $111K, which triggered a short squeeze and underscored robust institutional demand. The current distribution phase reflects healthy market mechanics rather than bearish reversal, with higher timeframe charts suggesting accumulation for the next leg up.

Bitcoin Price Prediction: Warnings of Pullback After $123.1K Peak

Bitcoin's rally to a record $123,100 has sparked concerns of a local top, with on-chain metrics flashing overextension signals. The cryptocurrency swiftly retreated 6% to $115,700 after touching the high, as advanced NVT readings crossed into historically dangerous territory—a zone that often precedes cycle peaks.

Despite the pullback, the bull market's structure remains intact. The current correction of 23.48% pales against previous cycle drawdowns of 30-80%, suggesting underlying strength. Technical patterns now show BTC consolidating in a symmetrical triangle, trapped between support at $116,000-$117,000 and descending resistance NEAR $120,000.

The compression typically precedes violent moves. A breakout above resistance could propel prices 6% toward $125,000, while failure to hold support may trigger a drop to $111,000. Market participants watch the apex forming near $117,837 for directional clues.

UK Bitcoin Sale May Raise £5B to Ease Budget Crisis

The United Kingdom is considering a significant sale of seized Bitcoin to address its budget shortfall. Chancellor Rachel Reeves is evaluating a plan to offload billions in UK-held Bitcoin, potentially raising £5 billion. This move underscores the growing intersection between cryptocurrency assets and traditional fiscal policy.

The proposed sale highlights Bitcoin's maturation as a liquid asset class capable of impacting national balance sheets. Such a large-scale divestment could introduce notable supply-side dynamics into the crypto markets during the execution period.

Corporate Bitcoin Accumulation Surges as Institutions Add $810M in Five Days

Wall Street's appetite for bitcoin has reached new heights, with 21 corporations collectively adding $810 million worth of BTC to their balance sheets between July 14-19. The buying spree coincided with Bitcoin's price surge to $123,000, signaling growing institutional confidence in digital assets as treasury reserves.

MicroStrategy maintained its position as the most aggressive accumulator, purchasing 4,225 BTC during the period. Japanese firm Metaplanet followed with 797 BTC, while French semiconductor company Sequans acquired 683 BTC. The acquisitions spanned multiple jurisdictions, including notable purchases from UK's The Smarter Web Company (325 BTC), Semler Scientific (210 BTC), and Australia's DigitalX (167 BTC).

Four companies initiated new Bitcoin treasury strategies totaling $99 million, with Bullish's IPO filing revealing a $92 million BTC position. The wave of institutional adoption reflects a broader trend of corporations diversifying reserves into hard assets as macroeconomic uncertainty persists.

Bitcoin Miners Unload Holdings at Record Pace Amid Price Surge

Bitcoin miners are capitalizing on the cryptocurrency's rally above $120,000, offloading a record 16,000 BTC to exchanges in a single day—the largest daily outflow since April. This surge in miner sales, as tracked by CryptoQuant, signals profit-taking behavior that could temporarily pressure prices.

The MOVE mirrors April's trend when miners sold 17,000 BTC during Bitcoin's ascent from $75,000 to $100,000. Miners typically sell to cover operational costs and lock in gains, but concentrated selling waves risk creating near-term market turbulence.

Mid-tier holders (100-1,000 BTC wallets) are joining the exodus, shedding 3,000 BTC from reserves. The coordinated profit-taking emerges as a counterpoint to Bitcoin's bullish momentum, testing the sustainability of its all-time high trajectory.

UK Considers £5 Billion Bitcoin Sale to Address Budget Deficit

The UK government is weighing the sale of over 61,000 seized bitcoins, now valued at more than £5 billion, as part of efforts to close a £20 billion budget gap. Chancellor Rachel Reeves faces mounting pressure to liquidate the assets amid rising borrowing costs and sluggish economic growth.

The bitcoin cache, originally worth £300 million when confiscated in 2018 from a Chinese Ponzi scheme, has appreciated dramatically with BTC's bull run. Legal complexities persist regarding potential restitution to fraud victims, particularly overseas claimants with unverified identities.

Critics argue the move echoes historical missteps where governments prematurely divested appreciating assets. The Treasury views the sale as preferable to austerity measures, though some analysts suggest holding could yield greater long-term gains as institutional adoption accelerates.

Bitcoin Inflows Surge as Satoshi-Era Miner Resurfaces, Signaling Market Resilience

Binance has recorded a dramatic reversal in Bitcoin flows, with $2.7 billion worth of BTC entering the exchange since July 11. The influx coincides with activity from a dormant Satoshi-era miner, which has moved over 80,000 BTC in recent weeks. Despite the substantial volume, Bitcoin's price stability underscores the market's resilience.

Long-term holders are capitalizing on the steady market, cashing out more aggressively than short-term traders. The SOPR ratio hovering at 1.9 suggests seasoned investors are locking in profits. Binance remains the focal point for major BTC movements, reinforcing its pivotal role in the cryptocurrency ecosystem.

Bitcoin Holds Strong in Profit Zone Amid Greed Surge, $200K Target in Sight

Bitcoin's rally to a record $122,838 on July 14 has settled into consolidation near $118,000, yet market Optimism remains unshaken. The Crypto Fear & Greed Index registers 68—firmly in greed territory—but well below the 75-80% extremes seen during prior peaks. Analysts interpret this as fuel for further upside before euphoria kicks in.

On-chain data reveals the 30-day moving average of the sentiment gauge has climbed to 66.2%, signaling sustained bullish conviction without overheating. The Logarithmic Growth Curve pattern suggests the pause is a breather, not a reversal, with technicals still aligned for a potential run toward $200,000.

Strategy’s $28B Bitcoin Windfall Demonstrates DCA Dominance

Strategy, the corporate Bitcoin accumulator formerly known as MicroStrategy, now sits on $28.22 billion in unrealized gains from its 601,000 BTC holdings. The firm's disciplined dollar-cost averaging approach across market cycles has delivered a 65.82% return on its $71.11 billion position.

With an average purchase price of $71,290 per bitcoin, the company maintains substantial downside protection even at current prices near $118,200. Recent acquisitions during May-July confirm its commitment to long-term accumulation, particularly after BTC breached the psychological $100,000 barrier.

The strategy contrasts sharply with short-term traders, instead building what analysts describe as a 'fortress balance sheet' that may redefine corporate treasury management. Bullish sentiment persists as Bitcoin consolidates between $118K-$120K alongside record ETF inflows.

Is BTC a good investment?

Based on current technicals and market dynamics, BTC presents a compelling investment case:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +3.7% premium | Bullish trend confirmation |

| MACD | Bullish crossover | Momentum shifting upward |

| Institutional Flow | $810M/5 days | Strong smart money demand |

| Key Resistance | $123K | Breakout would trigger new highs |

Robert maintains a 12-month price target of $180K-$200K, noting that dips to $111K support should be bought. The risk/reward ratio favors long-term holders, with proper position sizing recommended given volatility.

BTC remains a high-conviction investment for portfolios with appropriate risk tolerance. Dollar-cost averaging and holding through expected volatility near $123K resistance is the preferred strategy.